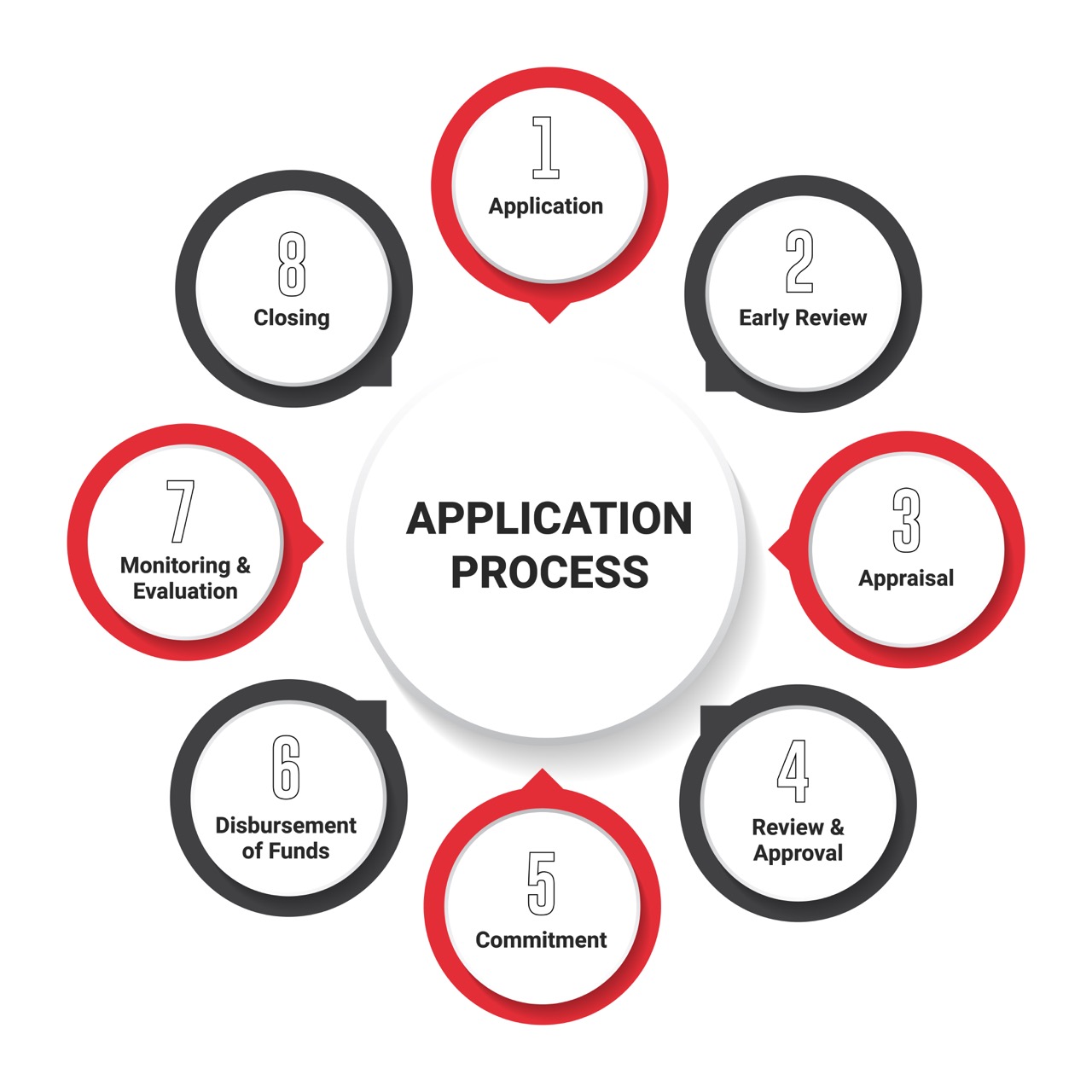

Facility Application Process

The application process begins with the submission of a duly completed Pre-Qualification Form to RDF. The pre-qualification process is brief, not more than one day, and allows RDF to assess the eligibility of a potential applicant before engaging in the Application Process. Once an applicant is deemed eligible, an application form will be submitted to the applicant, along with document requests.

RDF officers conduct a first-level review of the institution based on the initial information submitted and present a case to the management review body, the Investment Management Committee (IMC), to seek approval for full due diligence to be conducted.

The early review seeks to unearth any potential deal-breakers based on an initial assessment of the institution’s governance, operations and financial performance. Some of the reasons that can necessitate a rejection by IMC include

- Adverse performance trends that cast doubt on the future performance of the institution.

- A material post-audit occurrence with serious consequences to the stability and/or performance of the institution.

- Discovery of integrity and honesty issues in the submission of the application that amounts to a misrepresentation of issues to create a more favourable position of the institution than the reality.

- Any other issue(s) that comes to the attention of IMC which in their opinion is significant enough to create a level of discomfort in investing in the institution.

Upon approval, the RDF officers will submit a draft Term Sheet to the applicant for signature. The Term Sheet highlights the key terms and conditions of the proposed RDF facility.

- Review of Application Form

- Review of supporting documents

- Review of Secondary Data

- Review of Financial Statements

- Feedback given to FIs

-

The appraisal report is submitted to the RDF’s Investment Management Committee and Board Finance and Investment Committee (approving committees) for consideration and approval. RDF’s approving committees require that each proposal is clearly sustainable, has economic and financial merit, and contributes to the development of rural Ghana and the Sustainable Development Goals (SDGs), particularly

- SDG 1: No Poverty

- SDG 2: Zero Hunger

- SDG 5: Gender Equality

- SDG 7: Affordable and Clean Energy

- SDG 8: Decent Work and Economic Growth

Approval of the investment request is communicated to clients in writing, in the form of an offer letter, with the legal agreements attached.

Approvals are valid of six (6) months from the date of submission of the offer letter and legal agreements to the client. Beyond six (6) months, the appraisal of the client must be updated and resubmitted to the approving committee for a new approval

RDF and the client sign the legal agreements which include a Loan Agreement and a Deed Of Assignment or Mortgage Agreement, dependent on the type of assignment agreed.

Funds are disbursed to the client upon completion of all conditions precedent to disbursement. Funds may be disbursed to the client in full or in stages as agreed. For wholesale funding to Financial Institutions, RDF requires that the Institution opens an internal account for the receipt and disbursement of RDF’s loan.

RDF’s post-disbursement monitoring includes quarterly performance reports and an annual on-site verification visit. RDF, through its monitoring and evaluation ensures that clients utilise the funds for the intended purpose within the required timelines, that clients remain in the capacity to fulfil their obligations to RDF and the desired impact is being achieved, among others.

RDF closes its books on a debt when the funds are fully repaid.

POST DISBURSEMENT MONITORING

RDF Ghana LBG’s Post Disbursement Monitoring Process involves the following:

Role of Partner Financial Institutions

During the tenure of the loan, partner financial institutions shall visit the clients to ascertain the performance of the loans granted under the scheme. Quarterly reports including data on the loan repayments / recovery history of each loan made by partner financial institutions under the scheme will be submitted by partner financial institutions to RDF.

Role of RDF

During the tenure of the loan RDF shall undertake the following activities;

ON-GOING MONITORING

Ongoing monitoring visits shall be undertaken by the RDF aimed at assessing the status of the performance of RDF investment with partner institutions.

The monitoring process is phased into two as follows;

- Involves off-site analysis of information from reports or any other sources to form an objective impression on the status of the institutional performance in respect of RDF investment.

- Involves on-site visit to the institution with an agenda of issues identified so that proper conclusions about the status of RDF investment with the institution can be ascertained.

In all cases, RDF shall provide objective feedback to partner financial institutions as well as structure follow-up actions.

ANNUAL REVIEW

RDF shall undertake an annual review of the operations of partner financial institutions in respect of the performance of RDF investment. Review dates will be established with partner financial institutions during the disbursement process.

The aim of the annual review is for the RDF to be abreast of the current operations of partner financial institutions and also for RDF to become aware of any warning sign(s) for remedial action to be taken.

MONITORING & EVALUATION ACTIVITIES

RDF shall establish as appropriate monitoring and evaluation systems with clear baseline data, indicators, targets, and outputs including means of verification against which these targets and outputs can be measured.

RDF Investment Staff shall undertake bi-yearly monitoring and evaluation activities involving a percentage sample (of clients) of partner financial institutions under the RDF investment scheme.